What is Polkadot (DOT)?

Polkadot was launched in May 2020, and was developed by Gavin Wood. If that name sounds familiar, it’s because is also a founder of Ethereum, Kusama, Parity, and Web3 Foundation. It was primarily designed with the goal of making the rapidly expanding crypto ecosystem more interoperable – something that is needed if a world of different blockchains are to thrive.

The Polkadot project is managed by Switzerland-based Web3 Foundation, which is working with researchers from Inria Paris and ETH Zurich, developers from Parity Technologies, and capital partners from major crypto funds like Polychain Partners.

| Did you know? Polkadot gives DApp developers a convenient and affordable alternative to congested blockchains like Ethereum. They can build on a Polkadot parachain, but the apps will still work on other platforms, including Ethereum. Source: Polkadot.network |

Polkadot (DOT) Basics

DOT is the native crypto token of the Polkadot network. A DOT can be further divided into Planck. Originally, one DOT contained 1,000,000,000,000 Planck, but following a community vote, in 2020, this was redenominated, so that one DOT contains 1,000,000,000 Planck.

Unlike many other blockchains, Polkadot is a network protocol that allows all kinds of data, beyond just tokens, to be sent across different blockchains. It uses XCM, a secure cross-chain communication standard format and programming language. This makes it ideally suited to the multi-chain Web3 that is rapidly developing.

How Polkadot Works

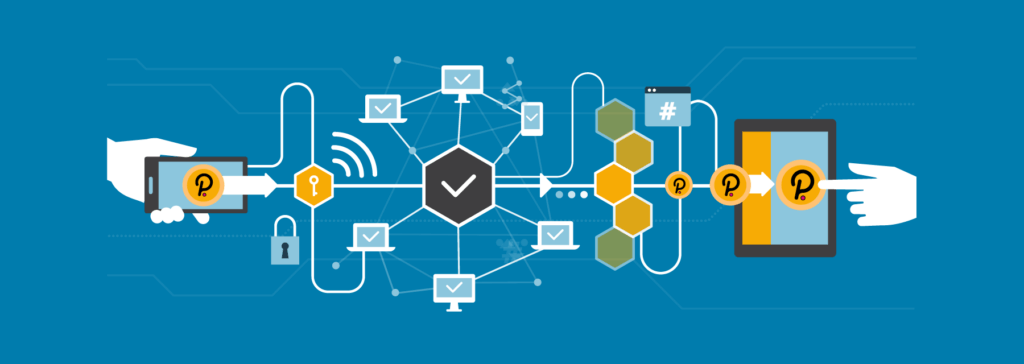

The Polkadot network relies on several different parts to work. While it can seem confusing, they can be broken down into these main parts:

- Relay Chain: The main part of Polkadot. This handles security, consensus and cross-chain interoperability.

- Parachains: Separate blockchains, often with their own tokens, optimised for specific roles and use cases.

- Parathreads: Like parachains, but use a pay-as-you go model, making them cheaper for less demanding blockchains.

- Bridges: Allow both parachains and parathreads to connect to and interact with other blockchain networks (e.g. Bitcoin and Ethereum).

- Nominators: Select validators and stake dots to secure the relay chain.

- Validators: Stake dots, validate proofs from collators, and work with other validators to reach consensus.

- Collators: Maintain and collect shard transactions from users, create proofs for validators.

The entire Polkadot network is governed by elected council members, who represent the passive stakeholders, and a technical committee who are developing the network.

Polkadot’s consensus algorithm is called GRANDAPA (GHOST-based Recursive Ancestor Deriving Prefix Agreement). When Polkadot is running well, this can finalise blocks almost instantly. If the network has issues, it can finalise millions of blocks in a single instance when the issues have been resolved.

DOT Supply

Unlike many cryptocurrencies, like Bitcoin and XRP, there’s no fixed limit to the supply of DOT tokens. This means it is inflationary, rather than deflationary, which should keep its price relatively low.

Polkadot (DOT) Adoption & Usability

From the very outset, Polkadot was designed for Web3, so it’s not surprising that it is becoming a popular network and has many use cases. Polkadot’s native crypto, DOT, has also become a popular payment method in its own right.

Polkadot and DOT use cases:

- Interoperability between different blockchains

- Securing the Polkadot network through staking

- Decentralised lending

- Payments

Polkadot Network Fees & Speed

When it comes to transaction fees, Polkadot gets a bit complicated again, using a weight-based fee model instead of a gas-metering system (like Ethereum, for example). But, for the vast majority of transactions, fees are tiny, amounting to no more than a few pennies. Transactions on the Polkadot network are almost instant if the network is running well.

| Did you know? Kasuma is ‘canary network’ (as in ‘canary in the coal mine’) for Polkadot. It features a virtual copy of Polkadot, allowing developers a space to experiment and test before launching their code, apps and projects. Source: Enjin.io |

Polkadot (DOT) Security and Safety

The Polkadot network itself is extremely secure thanks to its employment of ‘shared security.’ This allows any chain that becomes a Polkadot parachain to benefit from the security provided by the main Polkadot Relay Chain validators.

This is a big advantage over many other interchain protocols that build on bridges and require each chain to maintain its own validator and security. This is because, the bigger the validator set is, the harder it is for bad actors to take control of enough of the network to mount a so-called 51% attack.

Security and safety tips:

- Don’t leave your DOT on exchanges. Use exchanges for buying and selling only. Always transfer your crypto to a local wallet for short-term storage.

- For long-term storage, keep your crypto in a hard wallet.

- Always keep your wallet keys in multiple safe places – they cannot be recovered.

- Never tell anyone about your crypto holdings. No matter how secure your storage is, if you or your loved ones are physically threatened, you’ll probably hand over your personal keys.

Polkadot (DOT) Volatility

As with all cryptocurrencies except stablecoins, DOT has seen its fair share of price volatility. According to CoinGecko, during the 2021 crypto bull run, DOT hit a high of US$54.98, but by early October 2022, was trading at around $6. Still, the increasing adoption and utility of the Polkadot network may help create a more stable price going forward as the Web3 ecosystem matures.

Final Word on Polkadot (DOT)

Polkadot is much more than just its crypto token, DOT – it’s a network that helps enable massive innovation in other networks. Because of this fundamental utility value, DOT can be considered to have very firm foundations compared to many other cryptos. However, the unlimited supply will obviously have a dampening effect in terms of price, so it might not be the best cryptocurrency for those just looking for an investment.

Similar Cryptos to DOT

Because of the nature of the Polkadot network, it’s difficult to compare DOT to other cryptos. If you look at DOT from a purely transactional perspective, it can be compared to the likes of Solana (SOL) in terms of speed and low fees.