DeFi Platforms

Everything You Need to Know About Decentralised Finance PlatformsSmart contracts and blockchain technology have made it possible to provide financial services without a middleman. This DeFi tech is revolutionising the loans, investment, insurance and other sectors. This guide will tell you everything you need to know to make the most of DeFi.

What is Decentralised Finance?

Decentralised finance, or DeFi as it is more commonly known, is simply any financial service provided via decentralised technology, like blockchain and smart contracts. Pretty much everything from the traditional financial services world, from loans and banking to investments and insurance, can now be accessed via a DeFi platform.

Decentralised Crypto Exchanges

Although the vast majority of crypto users still use centralised exchanges (CEXs), like Binance or Coinbase, there are decentralised alternatives. Decentralised exchanges (CEXs) still tend to be less user-friendly than their centralised counterparts, but do have some significant advantages.

Advantages of DEXs

- Self-custody: You never have to entrust your crypto assets to a third party

- Permissionless and trustless: No one can stop you from transacting and you don’t have to trust any third party

- Cheaper: Because you cut out the middleman, fees are lower

- Quicker: There’s no approval process or KYC procedures to delay things

- Integration: DEXs can be integrated into other platforms, making them very convenient

Disadvantages of DEXs

- Less user-friendly: DeFi as a whole is still in its infancy, so user interfaces and processes are not so refined as on centralised platforms

- No regulatory oversight: Because they are not regulated, if something does go wrong, there’s no one to turn to

Popular Decentralised Crypto Exchanges

Uniswap

An Ethereum-based decentralised crypto exchange, at the time of writing Uniswap, was the biggest DEX by volume for ERC-20 tokens. It is widely regarded as the DEX that provided the blueprint for subsequent exchanges.

Curve

At the time of writing, stablecoin-focused Curve was the biggest DEX in terms of TVL (Total Value Locked). Because it focuses on liquidity pools made up of assets with similar price relationships (for example, US dollar-pegged stablecoins like USDT and USDC), it offers efficient swaps and minimises slippage. Those providing liquidity are rewarded with Curve’s governance token, CRV.

PancakeSwap

The leading DEX on BSC (Binance Smart Chain), PancakeSwap’s native token is CAKE, which can be staked on the exchange to earn yield. The exchange is well regarded because of its impressive liquidity and extensive yield-generating opportunities.

SpookySwap

Built-in the Fantom ecosystem, SpookySwap also provides a cross-chain bridge and offers competitive yield farming pools. The native token is BOO, which can also be staked for enhanced yields.

Decentralised Lending and Borrowing Protocols

One of the most popular uses of DeFi technology is lending. The principle is simple, just like in the traditional financial services world, a user can take out a loan, usually at an agreed interest rate, repayable over a set period of time.

However, in the case of DeFi, the loan and collateral will be in crypto or other digital assets (like NFTs), and the lenders will be other platform users, rather than a centralised entity like a bank. Thanks to the use of blockchain-based smart contracts, there is no middleman to pay, no central point of potential failure, and the entire process is trustless (meaning no party is required to trust another party).

Unfortunately, DeFi lending has gotten some bad press due to high-profile failures of platforms like Celsius. But, many argue platforms like Celsius were not truly decentralised because they were run by a centralised organisation – this single point of failure was highlighted when the platform collapsed after the Terra LUNA crisis of mid-2022.

Advantages of DeFi Lending and Borrowing Protocols

- Much quicker than traditional financial services: There’s no approval process or documentation needed. You don’t need to visit any institution or prove anything.

- Totally fair: You cannot be discriminated against. As long as you meet the set criteria, you will be accepted, and treated the same as everyone else.

- Immutable: DeFi protocols are blockchain-based, so everything is written permanently on-chain.

- Permissionless and trustless: You don’t have to put your trust in anyone else.

- Self-custody: You retain control over your own digital assets.

- Cross-Chain Interoperability: Increasingly, DeFi protocols are compatible with multiple blockchains, giving ever greater choice and flexibility.

- More affordable: Because they cut out the need for middlemen and institutions, transactions are far cheaper than traditional financial services.

Disadvantages of DeFi Lending and Borrowing Protocols

- Not so user-friendly: DeFi is still a relatively new technology, so the user experience is often far from refined. You will need patience until you are familiar with a protocol.

- No regulatory oversight: The DeFi world is still unregulated, and due to its nature, is likely to remain so for some time. This means nothing is insured, and no one’s going to rescue you if a platform fails.

- Exposed to crypto volatility: Because DeFi platforms are reliant on cryptocurrencies, they can be impacted by the notorious volatility of crypto markets.

- Lack of transparency: Considering the inherently transparent nature of blockchain and DAOs, this may seem like a contradiction. But, there are projects that deliberately obscure their true structure via complicated technical structures.

Popular decentralised lending platforms

MakerDAO

A decentralised application (DAPP), MakerDAO is one of the largest ecosystems on the Ethereum blockchain, and allows the lending and borrowing of various digital assets without any counterparty risk. The platform uses a dollar-pegged stablecoin called DAI, and a governance token called MKR.

Aave

A popular non-custodial liquidity market platform, Aave allows users to deposit or borrow. The depositors, who provide the funds, earn a passive income depending on the market demand for loans. The platform is decentralised and governed by a DAO, which uses the AAVE token – an ERC-20 token based on Ethereum.

Compound

Another popular DeFi lending app, Compound is an algorithmic, autonomous interest rate protocol. It allows lenders to deposit into lending pools and earn interest, while borrowers can take loans. Compound’s native token is called COMP and is an ERC-20 token on the Ethereum blockchain. The Compound protocol is integrated with various other interfaces, including Coinbase Custody, Fireblocks, Bitgo, Ledger, OKEx, Binance, Exodus, Ankr, Eidoo, Cointracker and more.

This video shows you how Compound is integrated with Exodus wallet:

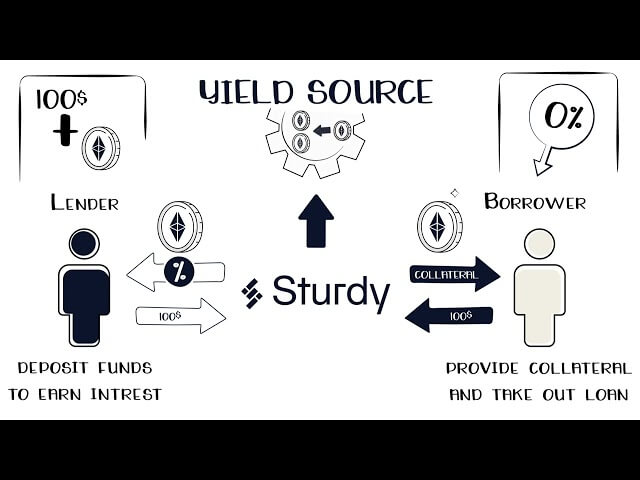

Sturdy

This DeFi platform offers both high-yield lending and interest-free borrowing. While that may seem too good to be true, it actually uses a fairly simple system. Instead of charging borrowers interest, it stakes the collateral contributed by lenders and pays them the yield generated. This makes it the first positive-sum lending platform. Sturdy is based on the Fantom blockchain.

DeFi Analytics Platforms

The DeFi ecosystem generates an exponentially growing amount of data, so great analytics platforms are a must for making sense of it all. Thankfully, there are some great DeFi analytics platforms available. Some of the most popular are:

Chainbeat

A data insights and analytics platform for Web3, Chainbeat provides cross-blockchain analytics covering active users, transactions, transfers, and events. Custom reporting and real-time alerts are available.

DeepDAO

As the name suggests, DeepDAO provides various information, both quantitative and qualitative, about the various DAOs. At the time of writing, it covered 10,008 organisations, with enriched data for 2,278.

DefiLlama

A community-maintained, multi-chain dashboard providing a wealth of information about the DeFi space, DefiLlama is one of the most trusted analytics platforms. There are no ads or sponsorships, just useful data presented in a clear way.

Decentralised Asset Management Platforms

With so many DeFi protocols and DApps swirling around, the DeFi place can get more than a little complicated. Luckily, there are platforms to help you manage it all. As previously mentioned, the various DeFi protocols are integrated with other platforms, including popular wallets like Exodus and CoinBase. But there are also dedicated advanced DeFi management platforms.

DeFi Saver

Providing an intuitive user interface, DeFi Saver allows you to manage all aspects of your DeFi investments, across different lending protocols and staking funds, and create customised transactions or refinance loans. It also provides a handy simulation module, so you can experiment before you commit.

Orion

Billing itself as “your single point of access to the crypto market”, Orion supports trading, staking, and bridge services across multiple platforms. It also boasts a development kit, NFT aggregator, and has a native token called the ORN coin.

DeFi Insurance Platforms

Given the notorious volatility of crypto, the ever-present threat of hacks, and the experimental nature of many DeFi projects, it’s only natural that users want insurance to mitigate risks. Luckily, there are an increasing number of insurance protocols, specially designed to meet DeFi needs.

Below are some of the most popular DeFi insurance protocols:

Insurace.io

At the time of writing, Insurace.io covered 142 protocols and 20 public chains, and said it was covering $348.8M of value. The platform offers coverage of various risks, including smart contract vulnerability, custodian risk, IDO event risk, and stablecoin depeg risk. Those providing capital through staking are rewarded with INSUR tokens.

Nexus Mutual

An Ethereum-based protocol, Nexus Mutual offers coverage for risk involving the exploitation of code vulnerabilities, including smart contract failure and exchange hacks. Those backing the project as members have rights based on their NXM token holdings.

Is DeFi Safe?

Like everything in the crypto space, DeFi is safe as long as you do appropriate research and take reasonable precautions. You can easily find out about the reputation of individual protocols by checking out what the crypto community is saying. Just be wary of influencers who are promoting specific solutions, because they might have a vested interest.

When interacting with any DeFi protocol, always make sure you’re practicing good digital security. After all, it doesn’t matter how secure a protocol is if the device you are using is compromised. Always keep up to speed with developments in the space, so that you can react quickly if problems develop, and never invest or stake more than you can afford to lose.

Always keep in mind that although decentralisation has many benefits, it does mean you are solely responsible for your own safety. There is no regulated bank or institution to compensate you if something goes wrong.

Is DeFi Legal?

This is a very difficult question to answer. Precisely because DeFi is decentralised, it is virtually unregulated. This isn’t necessarily because DeFi projects are doing anything wrong or illegal, but rather that when there is no central entity that owns something, there’s no jurisdiction for a regulator to claim. Furthermore, because the sector is still in its infancy and moving so quickly, laws and regulations haven’t caught up.